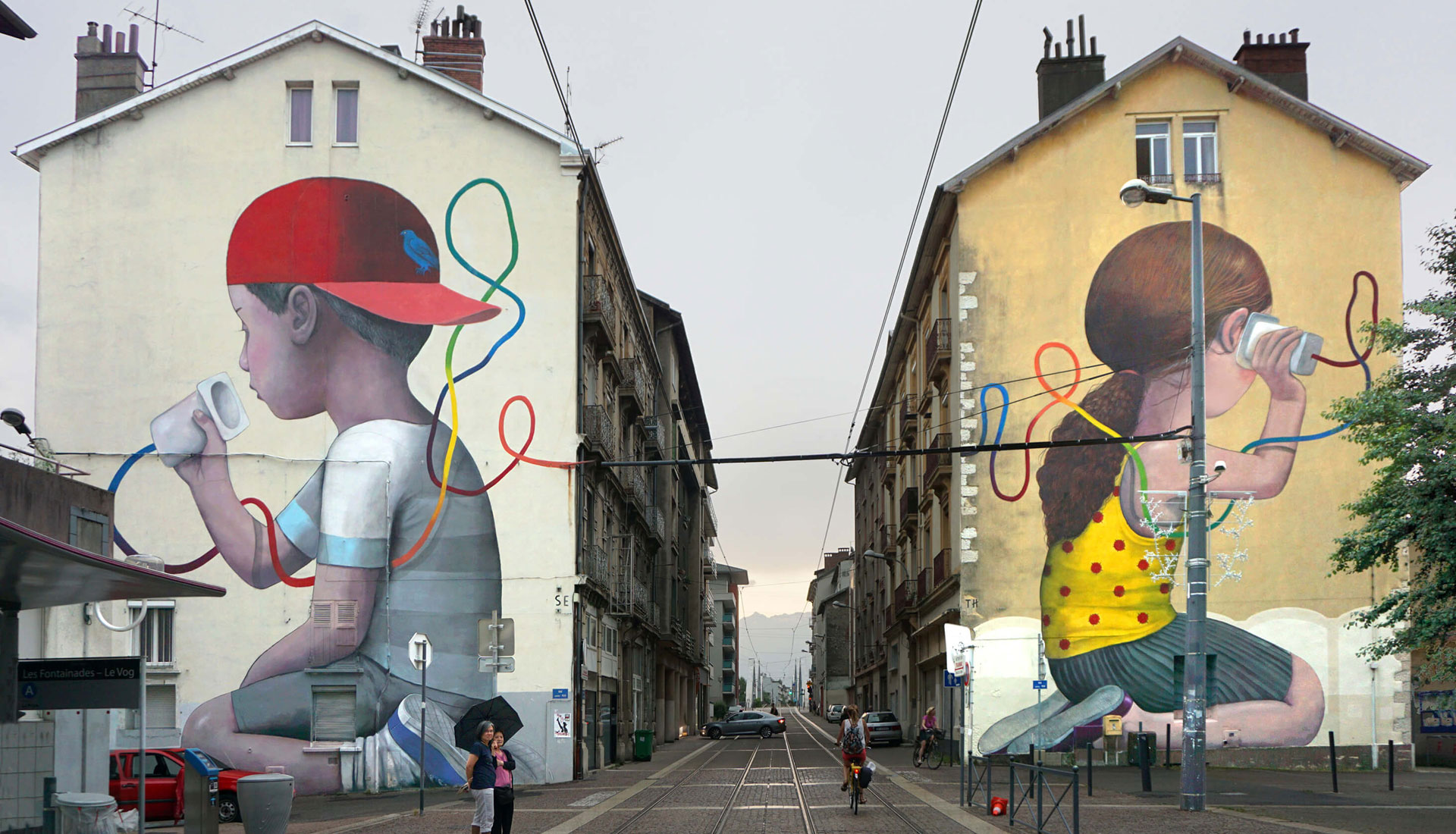

Διακόσμηση των Τοίχων του Παιδικού Σταθμού και του Νηπιαγωγείου Αγναντερού | Karditsa Portal - Η ηλεκτρονική εφημερίδα της Καρδίτσας

Αυτοκόλλητο τοίχου Πολύχρωμα εμπνευσμένα αποσπάσματα Αυτοκόλλητο τοίχου Βινυλικό Splatter Αυτοκόλλητο τοίχου Motivational Αυτοκόλλητο εμπρός με ρητό Αυτοκόλλητα τοίχου για την τάξη σχολείου υπνοδωματίου Playroom Διακόσμηση τοίχου παιδικού σταθμού ...

ΔΙΑΚΟΣΜΗΣΗ ΣΧΟΛΕΙΟΥ…15 ΠΙΝΑΚΕΣ ΜΕ ΕΙΚΟΝΕΣ «ΤΟ ΣΧΟΛΕΙΟ ΜΑΣ ΓΙΟΡΤΑΖΕΙ…ΔΕΝ ΞΕΧΝΩ»… – ΤΑ ΝΕΑ ΤΟΥ ΓΡΑΦΟΥΛΗ

1 τμχ, Διακόσμηση banner φόντου Προμήθειες σχολικού πάρτι πρώτης ημέρας Τάξη γραφείου Σχολείο φωτογραφικού θαλάμου Διακόσμηση τοίχου εσωτερικού/εξωτερικού χώρου - Temu Greece

Διακόσμηση του σχολικού κτιρίου στο Pervomaiskaia στο Kandalaksha μέχρι το Νέο Έτος 2020 Εκδοτική Εικόνες - εικόνα από : 166361201

Αγοράστε Εκπαίδευση μάθησης Σχολείο Νηπιαγωγείο Τέχνη τοίχου Καμβάς Ζωγραφική Αφίσες Και Εκτυπώσεις Εικόνες Τοίχου Παιδί Παιδικό Δωμάτιο Μωρό Κρεβατοκάμαρα Διακόσμηση | Joom

Αγοράστε Παιδικές ταπετσαρίες για το δημοτικό σχολείο και το νηπιαγωγείο — ηλεκτρονικό κατάστημα Uwalls

DIY Crafts Αξεσουάρ Φύλλα Χειροποίητο μαξιλάρι από τσόχα Non Woven Πράσινο μπάλωμα Δέντρου Νηπιαγωγείο Διακόσμηση τοίχου σχολείου Παιδικό πάρτι - Badu.gr

1 Τμχ, Επιγραφή, Υπέροχη Διακόσμηση Τάξης Πινακίδα Ξύλινη Πινακίδα, Ξύλινη Πινακίδα, (11,81x11,81 Ίντσες/30cmx30cm), Διακόσμηση Τοίχου, Διακόσμηση Σπιτιού, Διακόσμηση Δωματίου, Διακόσμηση Τάξης, Διακόσμηση Σχολείου | Εξοικονομήστε Περισσότερα Με ...

ΑΥΤΟΚΟΛΛΗΤΗ ΕΤΙΚΕΤΑ αυτοκόλλητο διακοσμητικό τοίχου Μίκυ Μάους αυτοκόλλητο βρεφικού δωματίου μωρό Διακοσμητικά αυτοκόλλητα φθηνά αυτοκόλλητα | zella.gr

Αγοράστε Εκπαίδευση μάθησης Σχολείο Νηπιαγωγείο Τέχνη τοίχου Καμβάς Ζωγραφική Αφίσες Και Εκτυπώσεις Εικόνες Τοίχου Παιδί Παιδικό Δωμάτιο Μωρό Κρεβατοκάμαρα Διακόσμηση | Joom

DIY Crafts Αξεσουάρ Φύλλα Χειροποίητο μαξιλάρι από τσόχα Non Woven Πράσινο μπάλωμα Δέντρου Νηπιαγωγείο Διακόσμηση τοίχου σχολείου Παιδικό πάρτι - Badu.gr

Αγοράστε Εκπαίδευση μάθησης Σχολείο Νηπιαγωγείο Τέχνη τοίχου Καμβάς Ζωγραφική Αφίσες Και Εκτυπώσεις Εικόνες Τοίχου Παιδί Παιδικό Δωμάτιο Μωρό Κρεβατοκάμαρα Διακόσμηση | Joom

-750x750.jpg)

-750x750.jpg)