Cosmodata - Μηχανικό Gaming Πληκτρολόγιο Razer Blackwidow V3 TKL. Το πρώτο και πιο εμβληματικό Gaming Mechanical Keyboard στον κόσμο, επιστρέφει μικρότερο και καλύτερο. Εξοπλισμένο με τους παγκοσμίου φήμης μηχανικούς διακόπτες Razer και

Razer BLACKWIDOW V3 QUARTZ – Mechanical Keyboard (Green Switch) – Wrist Rest – US Layout – JMCtech.gr

Το νέο πληκτρολόγιο Razer BlackWidow V4 75% περιλαμβάνει διακόπτες με δυνατότητα εναλλαγής για τα πλήκτρα του - TechWar.GR

Razer Huntsman Mini Gaming Μηχανικό Ενσύρματο Πληκτρολόγιο 60% με Razer Clicky διακόπτες και RGB φωτισμό (US) | Public

Razer Cynosa V2 Gaming Πληκτρολόγιο με RGB φωτισμό (Ελληνικό) – Κατάστημα τεχνολογίας, κινητά τηλέφωνα και επισκευές

Razer BlackWidow V4 Underglow Gaming Μηχανικό Πληκτρολόγιο με Razer Yellow διακόπτες και RGB φωτισμό (Αγγλικό US) - Tetrabyte.gr

Πληκτρολογιο Razer Blackwidow Quartz Tournament Chroma V2 (green Switch) US - Πληκτρολογιο (PER.576114) : e-shop.cy

Razer BlackWidow V3 Gaming Μηχανικό Πληκτρολόγιο με Razer Green διακόπτες και RGB φωτισμό (Αγγλικό US) | Skroutz.gr

Το νέο πληκτρολόγιο Razer BlackWidow V4 75% περιλαμβάνει διακόπτες με δυνατότητα εναλλαγής για τα πλήκτρα του - TechWar.GR

Gaming Πληκτρολόγιο Razer Huntsman Mini 60% Linear Optical Red Switch (RZ03-03390400-R3M1) | EuroSupplies

Razer Huntsman Mini Gaming Μηχανικό Πληκτρολόγιο 60% με Razer Clicky διακόπτες και RGB φωτισμό (Αγγλικό US) | Skroutz.gr

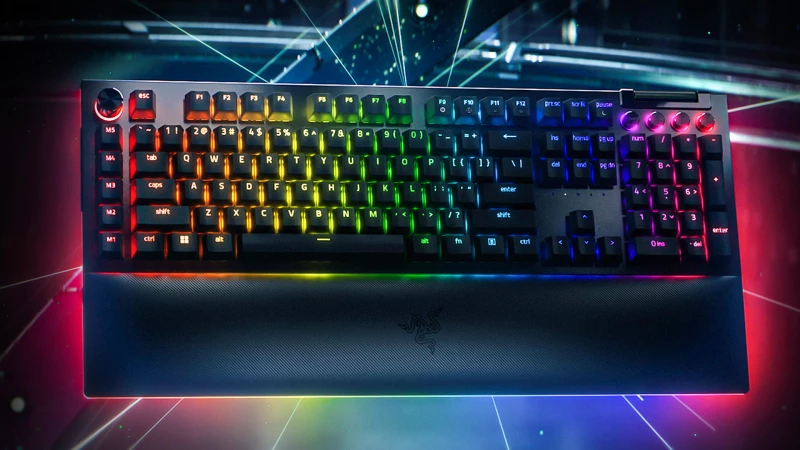

Razer BLACKWIDOW V4 PRO - Gaming Mechanical RGB Keyboard - Green Clicky Switches - Macros | GMshop.gr

Razer Πληκτρολόγιο Blackwidow v3 Pro Wireless Green Switches US (RZ03-03530100-R3M1) (RAZRZ03-03530100-R3M1) – Web Toner: Τόνερ | Μελάνια | Συμβατά | Toner

Razer Huntsman V2 TKL Gaming Μηχανικό Πληκτρολόγιο Tenkeyless με Razer Linear διακόπτες και RGB φωτισμό (Αγγλικό US) Quartz - Tetrabyte.gr